Now, by how much do we grow, the free cash flow is the next big question? Well, the growth rate you would assume should be as conservative as possible. The best way to predict the future free cash flow is by estimating the historical average free cash flow and then sequentially growing the free cash flow by a certain rate… This is a standard practice in the industry. You may now have a fair point in your mind – When the idea is to calculate the future free cash flow, why are we calculating the historical free cash flow? The reason is simple while working on the DCF model we need to predict the future free cash flow.

The net cash from operating activities is highlighted in green, and the capital expenditure is highlighted in red. Please note, the Net cash from operating activities is computed after adjusting for income tax. Here is the snapshot of ARBL’s FY14 annual report from where you can calculate the free cash flow – Let us calculate the FCF for the last 3 financial years for ARBL – ParticularĬash from Operating Activities (after income tax) The formula is –įCF = Cash from Operating Activities – Capital Expenditures Hence as an investor to assess the company’s true financial health, look at the free cash flow besides the earnings.įCF for any company can be calculated easily by looking at the cash flow statement.

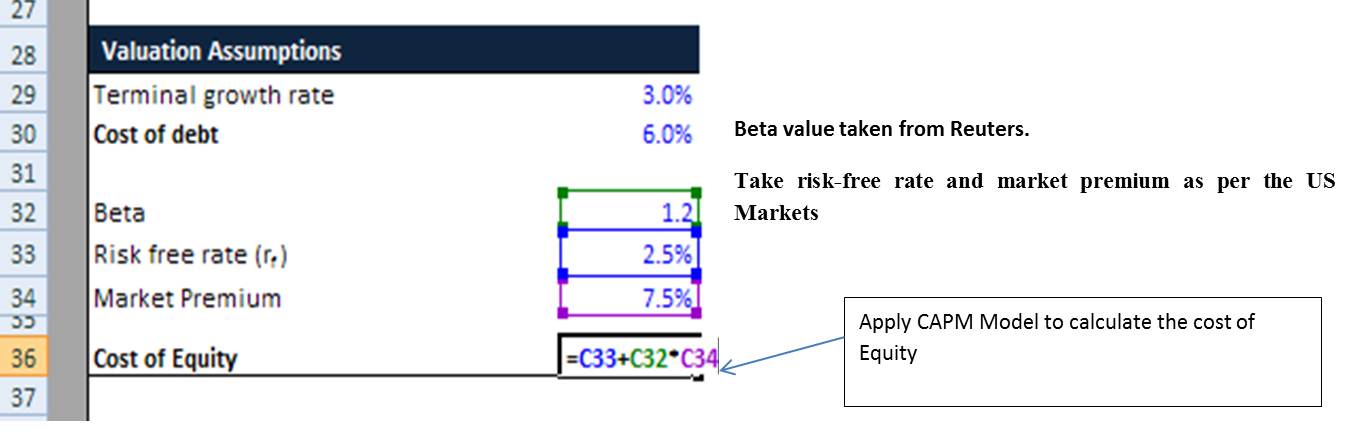

Thus the Free cash flow helps us know if the company has generated earnings in a year or not. Hence investors often look out for such companies whose share prices are undervalued but who have high or rising free cash flow, as they believe over time, the disparity will disappear as the share price will soon increase. When the company has free cash flows, it indicates the company is healthy. Thus, free cash is the amount of cash the company is left with after paying all its expenses, including investments. The mark of a healthy business eventually depends on how much free cash it can generate. This is the cash that shareholders enjoy after accounting for the capital expenditures. The free cash flow is basically the excess operating cash that the company generates after accounting for capital expenditures such as buying land, building and equipment. We need to consider the cash flow for the DCF Analysis is called the “ Free Cash flow (FCF)” of the company. Towards the end of the previous chapter, we also toyed with the idea –What will happen if the company’s stock replaces the pizza machine? In that case, we just need an estimate of the future cash flows from the company, and we will be able to price the company’s stock.īut what cash flow are we talking about? And how do we forecast the future cash flow for a company? We added all the present value of future cash flows to get the NPV. In the previous chapter, to evaluate the pizza machine’s price, we looked at the future cash flows from the pizza machine and discounted them back to get the present value. With this, we will conclude the 3 rd stage of Equity Research, i.e. In fact, we will learn more about these concepts by implementing the DCF model on Amara Raja Batteries Limited (ARBL). Having understood this concept, we now need to understand a few other related topics to the DCF valuation model. NPV plays a vital role in the DCF valuation model. We discussed “The Net Present Value (NPV)” in the previous chapter. Notes: The current error page you are seeing can be replaced by a custom error page by modifying the "defaultRedirect" attribute of the application's configuration tag to point to a custom error page URL.15.1 – Getting started with the DCF Analysis This tag should then have its "mode" attribute set to "Off". It could, however, be viewed by browsers running on the local server machine.ĭetails: To enable the details of this specific error message to be viewable on remote machines, please create a tag within a "web.config" configuration file located in the root directory of the current web application. The current custom error settings for this application prevent the details of the application error from being viewed remotely (for security reasons). Runtime Error Description: An application error occurred on the server.

Runtime Error Server Error in '/' Application.

0 kommentar(er)

0 kommentar(er)